- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India to Remove the Google Tax from April 1

India to Remove the Google Tax from April 1

29-03-2025

- India will remove the 6% equalisation levy, commonly called the Google Tax, from April 1.

- The tax was introduced in 2016 to make foreign tech companies pay a fair share of tax.

- It applied to companies selling digital advertisements in India without a physical presence.

What Was the Equalisation Levy (Google Tax)?

- It was a 6% tax on the payment made by Indian businesses to foreign digital companies.

- It applied when Indian companies paid for online advertisements and digital services to foreign companies that did not have a permanent office in India.

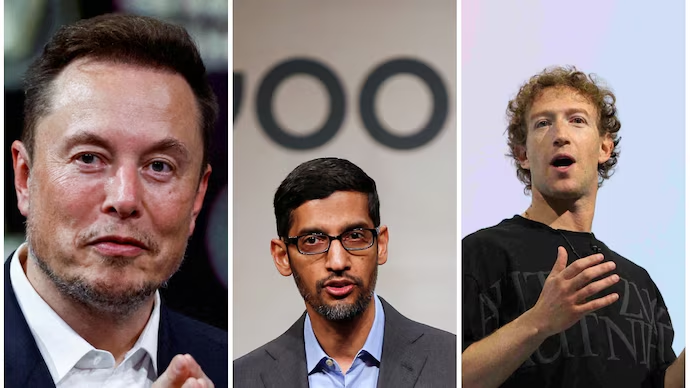

- It was introduced to ensure that big tech firms like Google, Facebook, etc., paid taxes on the large revenues they earned from Indian users.

- The tax targeted digital businesses operating across borders without being physically present.

- It aimed to level the playing field between domestic and foreign service providers.

Why Was It Called the Google Tax?

- It was informally named after Google because Google was one of the largest companies affected by this levy.

- Google, Facebook (now Meta), and other foreign platforms earned billions from digital ads in India but paid very little tax, which the levy tried to correct.

Why the Tax is Being Scrapped

- Major companies like Google and Meta began billing Indian clients through their Indian subsidiaries, making the levy not applicable.

- The tax became less effective and was seen as a barrier to foreign investment.

- India wanted to align with global digital tax norms and avoid trade conflicts, especially with the US.

- The revenue earned was small, but the policy friction was large, so the government decided to remove it starting April 1, 2024.

AMessage to the United States

- The decision may be a diplomatic signal to the US on resolving trade concerns.

- India wants to show that it is serious about removing barriers in digital trade.

- This could help India secure better tariff terms and avoid reciprocal taxes from the US.

Why Meta and Google Were Largely Unaffected

- Meta and Google were already not paying the equalisation levy in recent years.

- They route their ad sales through Indian entities—Meta India Pvt. Ltd. and Google India Pvt. Ltd.

- These companies already pay corporate taxes in India under regular tax rules.

Industry Response to the Announcement

- Executives from Meta and Google welcomed the removal of the tax.

- They said the move aligns India with global norms in online advertising taxation.

- They also said it will help grow India’s digital ad market and support tech innovation.

Big Tech’s Massive Reach in India

- Meta operates Facebook, Instagram, Messenger, and WhatsApp in India.

- Google runs ads on its platforms like Search and YouTube.

- India is the largest user base for both companies—YouTube has 490 million users and WhatsApp 530 million.

Their Share in India’s Digital Ad Market

- In 2023–24, Meta India earned ₹22,731 crore in advertising revenue.

- Google India earned ₹31,221 crore from ads during the same year.

- Together, they controlled 72% of India’s digital advertising market, worth $8.8 billion.

Why Experts Think This Move Makes Sense

- Experts said this move was expected and long overdue from a policy perspective.

- The tax mainly blocked small and mid-sized foreign ad companies from entering India.

- It also exposed India to risks of trade retaliation from the US, especially under previous administrations.

Legal and Policy Rationale Behind the Removal

- Lawyers noted that large firms like Meta and Google were already exempt from the tax.

- The levy only affected firms that lacked a permanent setup in India.

- Removing the tax helps open global market access to Indian artisans and small businesses.

- It also supports India’s aim to strengthen tech and trade ties with the US.

Long-Term Thinking Behind the Decision

- India exports significant technology talent and services to the US.

- Experts believe a stable, pro-tech policy benefits India’s digital and trade ecosystem.

- The revenue earned from the tax was relatively low, so scrapping it made economic sense.

- The government chose to remove the tax to focus on long-term growth and global alignment.