- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India’s FDI Journey Hits $1 Trillion

India’s FDI Journey Hits $1 Trillion

According to data from the Department for Promotion of Industry and Internal Trade (DPIIT), the cumulative amount of FDI inflows into India has crossed the $1 trillion milestone ($1,033.40 billion) in the April 2000-September 2024 period.

Key Highlights

- Growth in FDI: The decade from 2014-2024 saw an increase of 119% in FDI inflows compared to the preceding decade (2004-2014) according to the Union Ministry of Commerce and Industry.

- FDI Increase Over Two Decades: India’s FDI inflows have increased approximately 20 times from 2000-01 to 2023-24.

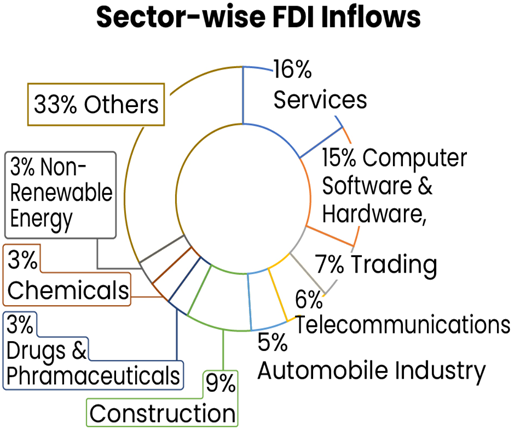

- Sector-wise FDI: Over the period from 2000-2024, the service sector attracted the highest equity inflow, amounting to $115.18 billion.

What is Foreign Direct Investment (FDI)?

FDI refers to investments made by a foreign entity in an Indian business with the intention of long-term operation, through capital instruments, in unlisted companies or in 10% or more of the paid-up equity capital of listed Indian companies.

Typically, FDI is a long-term investment and is considered a non-debt creating capital flow.

- Routes of FDI

- Automatic Route: The foreign investor needs to inform the Reserve Bank of India (RBI) after the investment has been made, without requiring prior approval.

- Government Approval Route: Foreign investors are required to obtain approval from the concerned Ministry or Department before making an investment.

- Regulations Governing FDI in India

- FDI Policy 2020 and FEMA (Non-debt Instrument) Rules, 2019 govern FDI in India.

- Primary Regulators: The Department for Promotion of Industry and Internal Trade (DPIIT) and the Reserve Bank of India (RBI) oversee FDI policies and rules.

|

Sectors where FDI is Prohibited

|

Foreign Direct Investment (FDI) vs. Foreign Portfolio Investment (FPI)

|

Parameters |

Foreign Direct Investment (FDI) |

Foreign Portfolio Investment (FPI) |

|

Form of Investment |

Long-term investment in business enterprises |

Investment in financial assets like stocks and bonds |

|

Type of Investment |

Includes financial and non-financial assets, including resources, technology, and securities |

Focused on financial assets such as stocks and bonds |

|

Volatility |

Low volatility due to extended investment periods |

High volatility due to quick investor sentiment changes |

|

Investor Control |

Higher control over business decisions |

Limited control, passive investors |

|

Liquidity |

Low liquidity due to long-term investments |

Highly liquid, easily tradable assets |

Challenges for FDI in India

- Complex Regulations and Policy Uncertainty: The intricate regulatory framework, including issues with tax laws and transfer pricing, leads to compliance challenges for foreign investors.

- Example: Vodafone's dispute over retrospective taxation.

- Institutional Deficiencies: Bodies like the Competition Commission of India (CCI) have been less effective in curbing anti-competitive practices.

- Example: The Flipkart controversy, which resulted in India losing its preferential treatment under the U.S. Generalized System of Preferences (GSP).

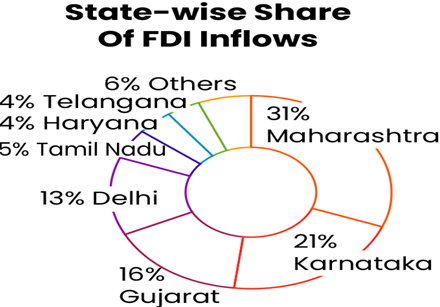

- Concentration of FDI: FDI is disproportionately concentrated in a few sectors like services and in urban regions, leading to developmental inequalities.

- Example: The lack of infrastructure in rural areas deters FDI.

- Impact on Local Businesses: The extensive operations of foreign companies often threaten local businesses that struggle to compete.

- Example: The opposition to Walmart’s entry into India.

- Impact on the Labor Market: FDI may raise concerns over job security and the displacement of local workers.

- Example: Legal action against companies like Amazon and Uber for poor working conditions in India.

Challenges Faced by the Indian Economy Due to FDI

- Dependency on Foreign Capital: Relying on foreign investment can lead to economic fluctuations due to external factors.

- Example: The global recession, protectionist measures, and the Russia-Ukraine war led to a drop in FDI inflows in 2023.

- Development vs. Environment: Poorly managed FDI projects can harm ecosystems and communities.

- Example: Vedanta Resources’ mining activities in Niyamgiri Hills faced opposition due to environmental concerns.

- Intellectual Property Concerns: Inadequate management of technology and intellectual property can prevent India from fully utilizing the expertise brought by international companies.

- Example: Bio-piracy in India’s pharmaceutical sector.

Steps Taken to Promote FDI Inflows

- Schemes for FDI Promotion: Initiatives like Make in India, Start-up India, PM Gati Shakti, National Industrial Corridor Programme, and the Production Linked Incentive (PLI) Scheme have boosted FDI inflows in alignment with Atmanirbhar Bharat.

- Promoting Ease of Doing Business (EoDB): Steps to reduce compliance burdens include the Jan Vishwas (Amendment of Provisions) Act, 2023, which has led to the reduction of over 42,000 compliances and decriminalized more than 3,800 provisions.

- Project Development Cells (PDCs): Each Ministry/Department has established PDCs to fast-track investment processes.

- Technological Interventions:

- The National Single Window System (NSWS) simplifies FDI approvals.

- The Foreign Investment Facilitation Portal (FIFP) serves as a single point for facilitating FDI.

- State Investment Summits: States like Gujarat and Uttar Pradesh have hosted Global Investment Summits to attract FDI.

- Example: The Vibrant Gujarat Global Summit attracted FDI worth USD 55 billion between 2002-2022.

Way Forward

- Infrastructure and Skill Enhancement: Strengthening infrastructure (e.g., high-speed rail, expressways) and upskilling the workforce in emerging sectors like renewable energy, semiconductors, and electric vehicles (EVs) can further attract FDI.

- Policy Reforms for Balanced FDI Inflows: Specific policies and separate rules for manufacturing and service sectors within Special Economic Zones (SEZs) will encourage more balanced FDI distribution.

- Recommendation: The Baba Kalyani Committee has suggested creating policies to attract FDI in manufacturing.

- Dispute Resolution and Contract Enforcement: Streamlining dispute resolution and strengthening contract enforcement through dedicated arbitration and commercial courts can provide legal certainty and enhance investor confidence.

- Promote Tier-II and Tier-III Cities: Encouraging FDI in smaller cities through cluster-based development initiatives like Bulk Drug Parks and Mega Food Parks can help spread investment across regions.

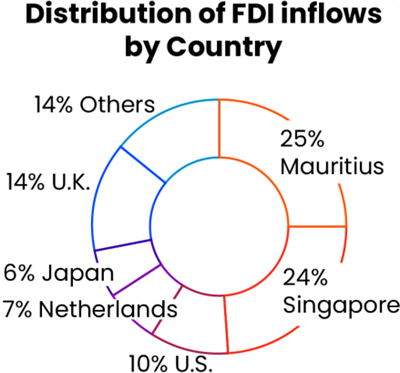

- Bilateral Investment Treaties (BITs): Strengthening and updating BITs with key nations can further ensure investor confidence by clearly defining terms and conditions for foreign investments.

|

Also Read |

|

| FREE NIOS Books | |