- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

India is the First Country To Release The Taxonomy Of Green Steel

India is the First Country To Release The Taxonomy Of Green Steel

13-12-2024

- India has set an ambitious goal to reach net-zero emissions by 2070, supporting global efforts to fight climate change.

- The steel industry, a major source of carbon emissions, plays an important role in this goal.

- Steel production contributes significantly to industrial emissions, so it's crucial for India to develop ways to reduce these emissions.

- To address this, India launched the Green Steel Taxonomy on December 12, 2024, organized by the Ministry of Steel & Heavy Industries.

- This is the world’s first framework that defines and categorizes green steel production methods based on their emissions.

- It shows India’s commitment to reducing carbon in the steel industry and improving its global competitiveness.

What is the Green Steel Taxonomy?

- The Green Steel Taxonomy is a framework designed to define, measure, and categorize steel produced with low carbon emissions.

- It creates a clear system for identifying how "green" steel is, based on emissions from its production. The taxonomy sets:

- Emission limits for steel production.

- A rating system to categorize steel by its emissions.

- A system for measuring, reporting, and verifying (MRV) emissions to track progress and ensure compliance.

- India is the first country to introduce such a system, setting a global example for sustainable steel production.

Key Features of the Green Steel Taxonomy

- Definition of Green Steel: Green Steel is defined as steel produced with less than 2.2 tonnes of CO2 equivalent per tonne of finished steel (tfs).

- The “greenness” of steel will depend on its emission intensity compared to this limit. Steel with lower emissions will get a higher “green” rating.

- Star Rating System

The taxonomy uses a star rating system to assess steel based on its emissions:- Five-star green steel: Emissions below 1.6 tCO2e/tfs.

- Four-star green steel: Emissions between 1.6 and 2.0 tCO2e/tfs.

- Three-star green steel: Emissions between 2.0 and 2.2 tCO2e/tfs.

Steel with emissions above 2.2 tCO2e/tfs will not be rated as green.

- Periodic Review and Updates

The thresholds for the star ratings will be reviewed every 3 years to keep up with international standards and industry progress. - Scope of Emissions

The taxonomy covers these types of emissions:- Scope 1: Direct emissions from steel production (e.g., burning fuel).

- Scope 2: Indirect emissions from purchased electricity, steam, and heating.

- Limited Scope 3: Emissions from activities like making raw materials (e.g., coke production, pellet making), but not from mining or transportation.

Verification and Certification:

- The National Institute of Secondary Steel Technology (NISST) will be responsible for the MRV process.

- Steel plants will be certified annually based on their emission reductions, with more frequent checks if needed.

Stakeholder Consultation

- Along with the Green Steel Taxonomy, consultations were held about the National Mission on Green Steel (NMGS) and the Green Steel Public Procurement Policy (GSPPP).

- These policies will help integrate green steel into India's procurement system and support low-emission steel production.

Strategic Importance of the Green Steel Taxonomy

- Decarbonizing the Steel Sector: The steel industry is responsible for about 8% of global CO2 emissions.

- In India, it's a large contributor to industrial emissions.

- The Taxonomy aims to help reduce these emissions and align with India’s 2070 net-zero goal.

- The Green Steel Taxonomy motivates steel producers to invest in cleaner technologies like hydrogen-based production and electric arc furnaces. These technologies are crucial for lowering emissions.

- Boosting India’s Global Competitiveness: With a growing global demand for low-carbon products, India’s steel industry can gain a competitive advantage. Green steel certification could help Indian manufacturers access markets that focus on sustainability.

- Creating a Market for Low-Carbon Products: By clearly defining what counts as green steel, the Taxonomy helps create demand for environmentally friendly steel, both in India and abroad. This could lead to new markets and partnerships with industries that care about sustainability.

- Supporting Stakeholder Collaboration: The success of the Green Steel Taxonomy depends on cooperation between the Ministry of Steel, industry players, research groups, universities, and international partners like the European Union. Working together is important for sharing knowledge, overcoming challenges, and speeding up the shift to green steel.

Challenges Ahead

- High Capital Requirements: Shifting to green steel production needs a lot of investment in new technologies and infrastructure. Steel plants in India may face financial challenges in making these changes.

- Technological Barriers: Technologies like hydrogen-based steel production are promising but still developing. They may not be available for all steel producers in India in the short term.

- Market Transformation: Encouraging consumers to prioritize green steel will require raising awareness and collaboration between industry players to shift market demand towards low-carbon steel.

|

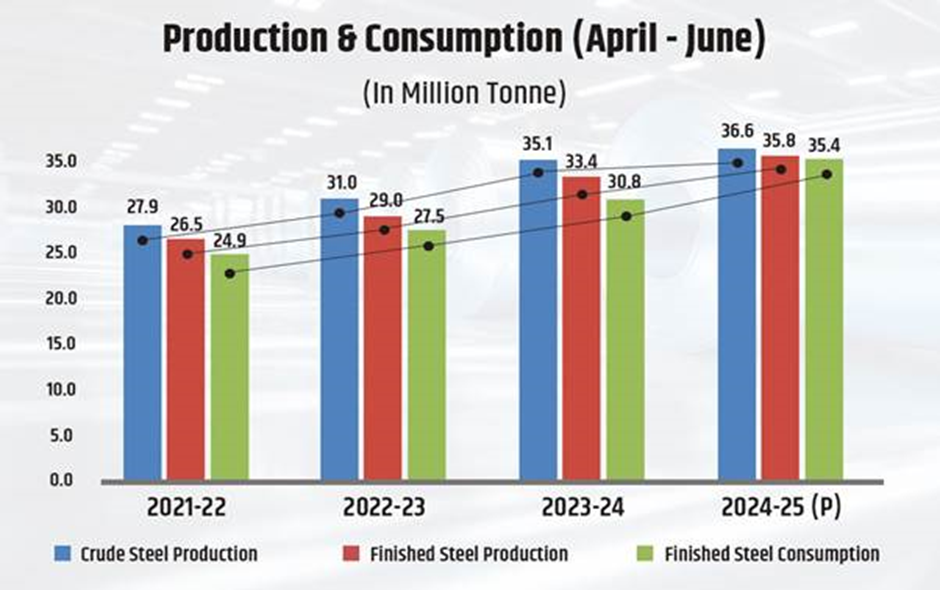

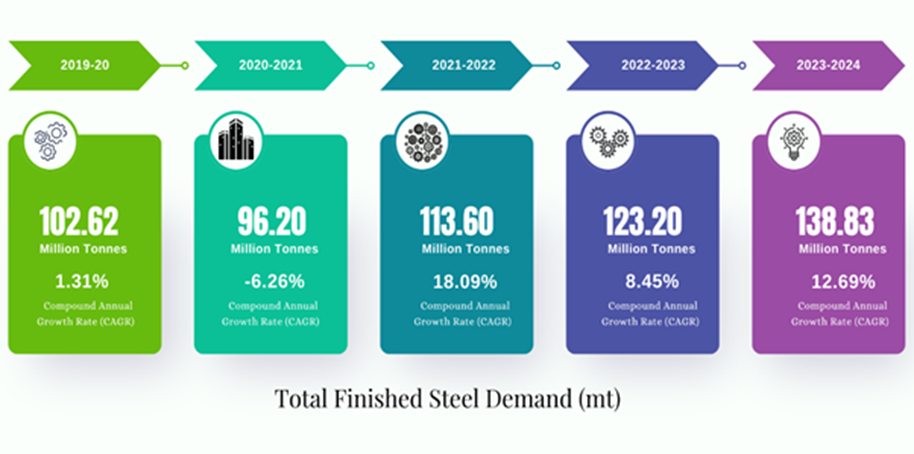

Indian Steel Sector

These initiatives collectively contribute to India's strong growth in the steel sector, promoting sustainability, technological innovation, and a competitive global position. |