- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

How to Read India's Balance of Payments

How to Read India's Balance of Payments

06-07-2024

I. Introduction

- India's current account registered a surplus in Q4 of 2023-24, but current account surpluses are not necessarily good, nor is a deficit always bad.

- Understanding India's Balance of Payments (BoP) is crucial to grasp the overall health of the economy.

II. What is Balance of Payments?

Balance of Payments (BoP)

- A record of India's transactions with the rest of the world.

- Like a ledger, showing money coming in (positive) and going out (negative).

- Affects the value of the rupee compared to other currencies (exchange rate).

- Example: If India imports $100 million worth of goods from the US and exports $80 million worth of goods to the US, the trade balance would be a deficit of $20 million.

III. Constituents of the BoP

The BoP has two main 'accounts': Current Account and Capital Account.

Current Account:

- Records transactions of a 'current' nature, divided into two subdivisions:

-

- Trade of goods (merchandise account): Export and import of physical goods, determining the balance of trade.

- Trade of services (invisibles): Services, transfers, and incomes, including banking, insurance, IT, tourism, transport, etc.

- Example: If India exports $10 million worth of software services to the US and imports $5 million worth of tourism services from the US, the invisible trade balance would be a surplus of $5 million.

Capital Account:

- Captures transactions related to investments, such as Foreign Direct Investment (FDI) and Foreign Institutional Investments (FII).

-

- Example: If a US company invests $50 million in an Indian startup, it would be recorded as a capital account surplus of $50 million.

|

A current account surplus doesn't always mean the economy is doing well.

A deficit doesn't always mean it's doing poorly.

The context matters (e.g., a surplus during a pandemic might not be a good sign).

|

IV. Role of RBI

- The Reserve Bank of India (RBI) plays a crucial role in managing India's BoP.

- The RBI intervenes in the foreign exchange market to stabilize the exchange rate and maintain foreign exchange reserves.

- The RBI also regulates the flow of foreign capital into the country, ensuring that it is consistent with the country's economic goals.

-

- Example: If the RBI intervenes in the foreign exchange market to prevent a sharp depreciation of the rupee, it may sell dollars from its foreign exchange reserves to stabilize the exchange rate.

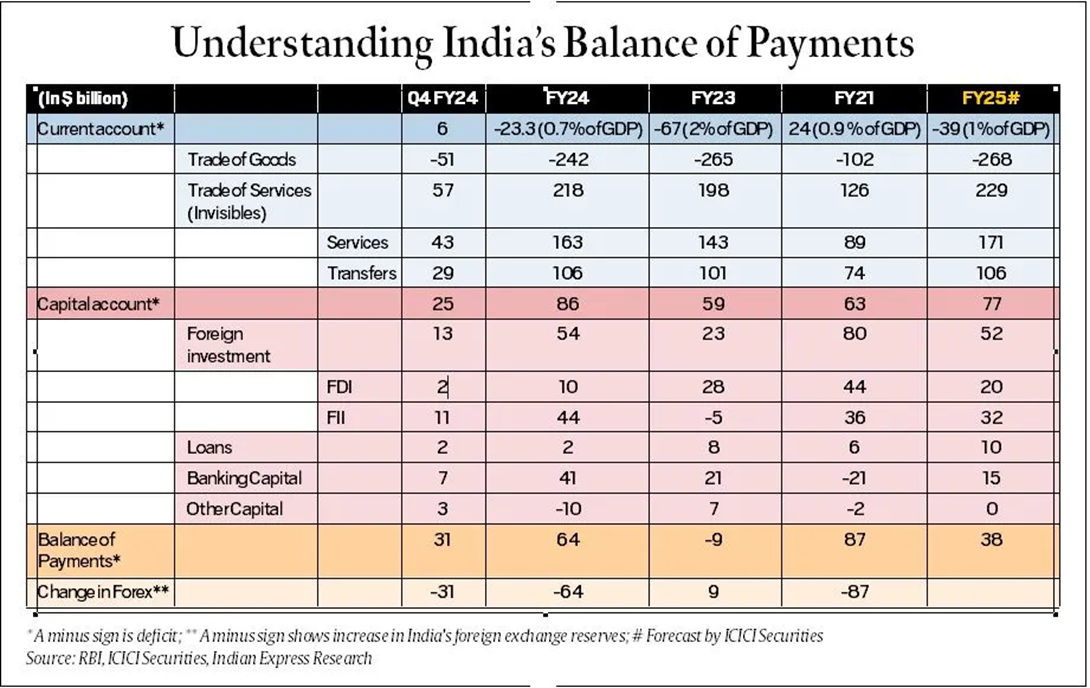

V. Reading the BoP Table

- The BoP table always balances through the change in the foreign exchange reserves column.

- A BoP surplus implies billions of dollars coming into the country, which the RBI adds to its foreign exchange reserves to prevent the rupee's exchange rate from appreciating.

- Contrary to popular perception, a current account deficit may not always be bad for an economy, nor is a current account surplus necessarily a good development.

-

- Example: If India's BoP surplus is $10 billion, it means that the country has received $10 billion more in foreign exchange than it has spent. The RBI would add this amount to its foreign exchange reserves, which would help to stabilize the rupee's exchange rate.

VI. Interpreting the Data

- The current account balance, which is surplus in Q4, is in deficit for the full year (FY2023-24).

- A current account deficit may indicate a developing economy's need to import capital goods to build up its capacity to produce more exports.

- A trade deficit suggests a strong demand impulse in the underlying economy.

- A current account surplus may not always be desirable, as seen in FY2020-21, which was a result of Covid-induced lockdowns.

-

- Example: If India's current account deficit is 2% of GDP, it may indicate that the economy is growing rapidly and needs to import more capital goods to support its growth.

VII. Importance of BoP

- The BoP is closely monitored as it impacts the exchange rate of the rupee and India's sovereign ratings.

- The BoP provides a comprehensive picture of the economy, helping policymakers to make informed decisions.

-

- Example: If India's BoP deficit is large and persistent, it may lead to a depreciation of the rupee, making imports more expensive and potentially fueling inflation.

VIII. Conclusion

Understanding India's BoP is crucial to grasp the overall health of the economy. A current account deficit of 1.5%-2% of GDP is consistent with a GDP growth rate of 7%-8%. The BoP data should be read in conjunction with other economic indicators to get a comprehensive picture of the economy.

Must Check: Best IAS Coaching In Delhi