- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Government Announces Special Assistance to States for Capital Investment 2023-24

Government Announces Special Assistance to States for Capital Investment 2023-24

Latest context

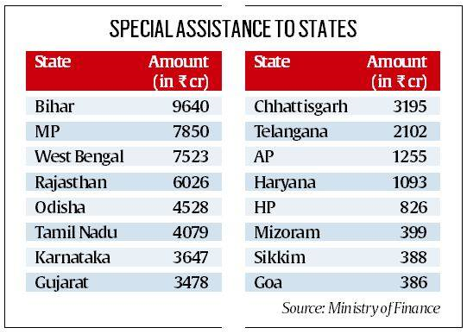

Finance Ministry's Department of Expenditure Approves Rs. 56,415 Crore Capital Investment for 16 States in FY 2023-24

More about news

The 'Special Assistance to States for Capital Investment 2023-24' scheme provides loans to 16 states including Bihar, Chhattisgarh, Goa, Gujarat, Haryana, Himachal, Pradesh, Karnataka, Madhya Pradesh, Mizoram, Odisha, Rajasthan, Sikkim, Tamil Nadu, Telangana, West Bengal, Arunachal Pradesh.

About the scheme

The Ministry of Finance introduced a scheme in 2020-21 to provide financial assistance to states for capital investment/expenditure in response to the COVID-19 pandemic. The scheme was implemented in the previous financial year as well.

The Scheme's Objectives

- The primary objective of the scheme is to generate a significant multiplier effect on the economy by stimulating demand and generating employment opportunities.

- Another key objective is to expedite projects in crucial sectors like the Jal Jeevan Mission and Pradhan Mantri Gram Sadak Yojana. This is achieved by providing funds to cover the state's share of the project costs.

- Furthermore, the scheme aims to incentivize states to undertake reforms in urban planning and urban finance. These reforms are intended to enhance the overall quality of life and governance in cities, leading to improved urban infrastructure and services.

Importance of the Scheme

- As part of the scheme unveiled in the budget for 2023-24, State Governments will be provided with special support in the form of a 50-year interest-free loan, amounting to a maximum of Rs. 1.3 lakh crore for the entire financial year.

- Capital expenditure involves the allocation of government funds towards long-term investments and development projects that create assets.

The importance of capital expenditure includes

-

Revenue Generation: Capital expenditure initiatives have the potential to generate revenue for the government through the creation of productive assets and infrastructure.

-

Economic Demand: Capital expenditure projects stimulate demand in the economy by creating jobs and income opportunities, leading to increased consumption and economic growth.

-

Private Investment Attraction: Capital expenditure signals the government's commitment to infrastructure development, attracting private investments and fostering economic expansion.

-

Labour Participation: Capital expenditure initiatives require labour, thereby increasing employment opportunities and enhancing labour force participation.

-

Productive Capacity Enhancement: Investments in capital projects improve the productive capacity of the economy, enabling increased output and productivity.

Scheme Allocation and Its Parts

Part I: Allocation of Rs. 1 lakh crore among States based on their share of central taxes & duties as per the 15th Finance Commission's award.

Part II: Incentives for the scrapping of old vehicles.

Part III: Reforms in urban planning.

Part IV: Reforms in financing for Urban Local Bodies (ULBs) to enhance their creditworthiness for Municipal Bonds.

Part V: Provision of housing for police personnel within or as part of urban police stations.

Part VI: Construction of Unity malls.

Part VII: Establishment of libraries with digital infrastructure at the Panchayat and Ward levels, primarily benefiting children and adolescents.

Part VIII: Incentives for the timely release of funds under Centrally Sponsored Schemes by state governments.

Must Check: IAS Coaching Centre In Delhi