- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

FOREIGN DIRECT INVESTMENT IN INDIA

FOREIGN DIRECT INVESTMENT IN INDIA

Latest Context

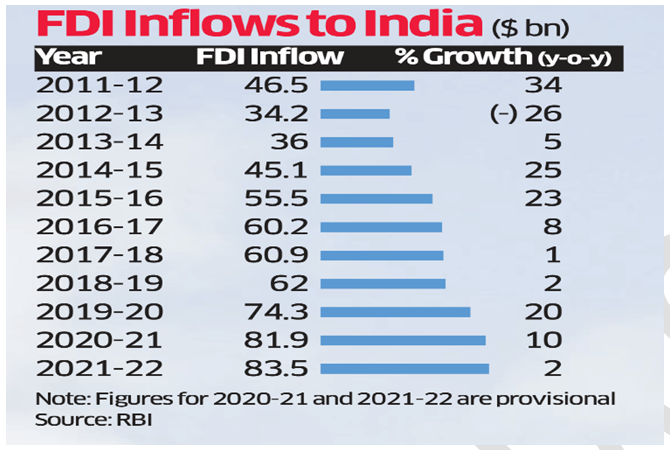

- India has experienced a notable downturn in its inflows of Foreign Direct Investment in the fiscal year (2022-2023) ending March 2023.

Data

- FDI inflows in comparison to the previous fiscal year reflect a decline of 16%, on a gross basis at USD 71 billion in FY23, marking the first decrease in FDI inflows in the past decade in our country.

Foreign Direct Investment (FDI)

• Foreign direct investment (FDI) refers to an investment made by an individual or entity from one country into a business located in another country, establishing a long-term connection.

• FDI can take various forms, such as purchasing shares, providing loans or technology transfers, and establishing subsidiaries or partnerships.

• FDI is widely acknowledged as a significant catalyst for economic growth. It brings financial resources, technological advancements, expertise, market-entry, and job opportunities to the recipient country.

Trends and Patterns of FDI Inflows in India

-

About: In recent years, India has emerged as a highly appealing destination for foreign direct investment (FDI) due to various factors such as its large and expanding domestic market, political stability, favourable demographics, improved business environment, and liberalized policy framework.

-

The Department for Promotion of Industry and Internal Trade (DPIIT) – Ministry of Finance, reports that India received a total FDI inflow of USD 871.01 billion between April 2000 and June 2022. According to the World Investment Report 2022 released by United Nations Convention on Trade and Development (UNCTD), India ranked 7th among the top 20 host economies in 2021.

- In the fiscal year 2021-2022, India witnessed its highest-ever FDI inflows of USD 84.8 billion, which included USD 7.1 billion in FDI equity inflows specifically in the services sector.

Country-wise FDI Equity Inflow FY-2021-22

-

Top 5 countries for FDI equity inflows: Singapore (27.01%), USA (17.94%), Mauritius (15.98%), Netherlands (7.86%) and Switzerland (7.31%)

Challenges Related to FDI Inflows in India

• Heavy Competition from Other Emerging Markets: India encounters competition from other emerging markets, including Indonesia, Vietnam, and China when it comes to attracting foreign direct investment (FDI).

• These countries present competitive advantages such as superior infrastructure, lower production costs and policies that are more favourable to investors.

• Taxation structure and Regulatory Compliance: In recent years, India has implemented numerous reforms to its tax system; however, complexities and uncertainties persist.

• Foreign investors face challenges related to compliance and tax planning due to frequent alterations in tax laws, multiple layers of taxation, and disputes arising from tax assessments.

• Deficit in Infrastructure: Despite continuous endeavours to enhance infrastructure, India continues to grapple with substantial deficiencies in crucial domains like logistics, transportation, telecommunications and power.

• Insufficient infrastructure poses challenges to the ease of conducting business and increases operational expenses for foreign investors.

Measures to be Taken to Boost FDI Inflows in India

• Simplifying and Streamlining Regulatory Processes: India has the opportunity to enhance the simplicity and efficiency of its regulatory processes, encompassing licensing, permits, and approvals.

• By adopting measures such as a single-window clearance system or a digital platform for regulatory compliance, the country can reduce bureaucratic hurdles and significantly improve the ease of doing business.

• Focussing on Infrastructure Development: Emphasizing the enhancement of infrastructure in key sectors like logistics, transportation, power and digital connectivity is crucial.

• By developing top-notch infrastructure facilities and establishing industrial clusters, India can attract foreign investors seeking efficient and well-connected business environments.

• Enhance Investor Protection Mechanisms: By bolstering investor protection mechanisms, which include ensuring strong enforcement of intellectual property rights (IPR), contract enforcement, and effective dispute resolution mechanisms, India can inspire confidence among foreign investors.

•This objective can be accomplished through judicial reforms, the establishment of specialized commercial courts, and the utilization of alternative dispute resolution methods.

• Promote Sector-Specific Investment Policies: By developing investment policies and incentives that are specifically tailored to key sectors like manufacturing, renewable energy, healthcare, technology, and e-commerce, India can attract foreign direct investment (FDI).

• Creating sector-specific policies that address the unique needs and requirements of each industry will serve as an incentive for foreign investors to make investments in those particular sectors.

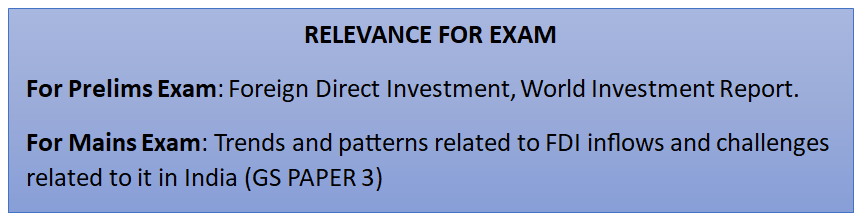

PRELIMS FOCUS

• Sustainable Development Goals (SDGs) associated with FDI and development:

SDG 8: Decent Work and Economic Growth

SDG 9: Industry, Innovation, and Infrastructure

SDG 17: Partnerships for the Goals

• World Investment Report: Released by the United Nations Conference on Trade and Development (UNCTAD)

• India's ranking: 7th among the top 20 countries

• India's FDI inflows: Managed by DPIIT (Ministry of Finance)

• FDI is strictly prohibited for the following activities: Agricultural or plantation activities, Nidhi company investments, Chit funds, Lottery, Atomic energy generation, Gambling, Trading in TDR, Cigarettes or tobacco-related industries.

• Three components of FDI: Reinvested earnings, Equity capital, and Intra-company loans.

Q. With reference to Foreign Direct Investment in India, which one of the following is considered its major characteristic? (2020)

(a) It is the investment through capital instruments essentially in a listed company.

(b) It is a largely non-debt-creating capital flow.

(c) It is the investment that involves debt-servicing.

(d) It is the investment made by foreign institutional investors in Government securities.

Ans: (b)

Q. Consider the following: (2021)

1. Foreign currency convertible bonds

2. Foreign institutional investment with certain conditions

3. Global depository receipts

4. Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

Ans: (a)

Q. Consider the following:

1. Foreign currency convertible bonds

2. Foreign institutional investment with certain conditions

3. Global depository receipts

4. Non-resident external deposits

Which of the above can be included in Foreign Direct Investments?

(a) 1, 2 and 3

(b) 3 only

(c) 2 and 4

(d) 1 and 4

Ans: (a)

Must Check: IAS Coaching Centre In Delhi