- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

FITCH DOWNGRADES US CREDIT RATING

FITCH DOWNGRADES US CREDIT RATING

Latest Context

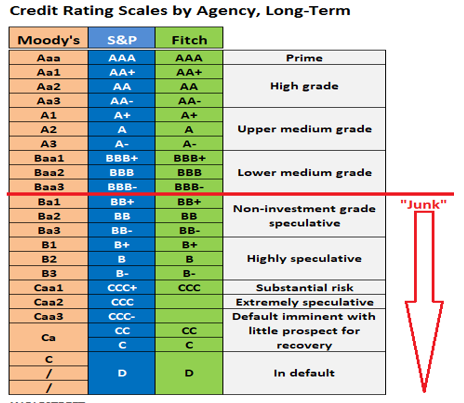

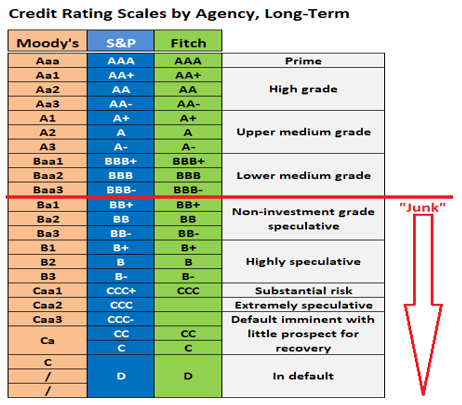

The United States credit rating was formerly rated at AAA, the highest possible level, but global credit ratings agency Fitch has now lowered it to AA+. The United States has now lost its AAA rating twice, after Standard & Poor's decision in 2011. For the rating, Fitch cited declining fiscal management confidence, ongoing debt ceiling negotiations, and fiscal deterioration.

What is the background of this downgrade?

- Since reaching the $31.4 trillion legal borrowing cap in May, the US government has been dealing with a debt ceiling problem. A legislative cap on how much money the federal government may borrow to pay for spending is known as the debt ceiling. The government runs the risk of going into default if the debt ceiling is not raised or suspended, which could set off a financial crisis and harm the world economy.

- To prevent a default, the US Congress and President came to a bipartisan deal in June to postpone the debt ceiling until January 2025. Fitch, however, stated that because this deal did not address the fundamental fiscal issues and political polarisation that have repeatedly led to debt crises, it was insufficient to restore trust in US fiscal management.

How would this affect India and other markets?

- Higher borrowing costs: If the US government has a poorer credit rating, lenders may demand higher interest rates from the US government, raising borrowing costs and widening the budget deficit. Other nations that borrow in US dollars or have their currencies tied to the dollar may also be impacted by this since they may be subject to greater finance costs and exchange rate pressures.

- Lower confidence: A lower credit rating may also make people less confident in the US economy, as well as its status as the world's leader and the issuer of the reserve currency. This might lower trade and investment in the US and harm its prospects for economic development. Other nations, like India, who rely on the US market or have close economic relations with it may also be affected by this.

- Greater volatility: Investors may seek out safer assets or diversify their portfolios away from US assets as a result of a lower credit rating, which might potentially lead to greater volatility in international financial markets. The stability and efficiency of various markets may be impacted by movements in stock prices, bond yields, currency rates, and commodity prices.

What initiatives can India take to reduce the impacts?

- accumulating foreign currency reserves, which act as a safety net against external shocks and exchange rate volatility. The reserves held by India are equal to 118% of its foreign debt and may be used to pay imports for more than 18 months.

- India has to lower its budget deficit, current account deficit, inflation, and public debt ratios to rebuild its macroeconomic foundations.

- India has put in place several initiatives to speed up its economic recovery from the COVID-19 epidemic, including a vaccination campaign, fiscal stimulus, monetary easing, liquidity assistance, and structural changes.

Challenges and the way forward for India

- Managing capital flows: India has to properly manage capital flows since both inflows and outflows might occur depending on national and international risk appetite. While outflows may rise if investors seek safer assets or lessen their exposure to US assets, inflows may rise if investors seek greater returns in emerging nations like India. India must weigh the advantages and disadvantages of capital flows about factors including growth, inflation, currency rates, and financial stability.

- Diversifying trade and investment partners: To avoid weaker demand and more competition from the US market, India has to diversify its trade and investment partners. India must also look at potential new markets, including those in the Association of Southeast Asian Nations (ASEAN), the European Union, the United Kingdom, Japan, and Australia. The Regional Comprehensive Economic Partnership (RCEP), the Comprehensive Economic Cooperation Agreement (CECA), and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) are just a few of the trade and investment accords that India needs to improve.

- Pursuing fiscal consolidation: Due to the US credit rating reduction, India has to seek fiscal austerity to avoid increased borrowing costs and decreased trust. While keeping enough spending on health, education, infrastructure, and social protection, India has to lower its budget deficit and public debt ratios. India needs to increase fiscal transparency, spending efficiency, and income mobilisation.

Conclusion

A momentous development that might have lasting effects on the world economy and financial markets is the downgrading of the US credit rating. India has taken some measures to lessen the effects of the downgrading, but there are still several chances and difficulties ahead. To better adapt to the changing global environment and increase its resilience and economic potential, India must take a cautious and proactive approach.

Must Check: IAS Coaching Centre In Delhi