- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

EXPORT PREPAREDNESS INDEX (EPI) 2022

EXPORT PREPAREDNESS INDEX (EPI) 2022

18-07-2023

↵

Latest Context

The third edition of the Export Preparedness Index (EPI) for States/UTs of India for the year 2022 was recently announced by NITI Aayog.

Facts about the Export Preparedness Index

- EPI is a comprehensive tool that measures the export preparedness of the States and UTs in India.

- Understanding the factors that affect export performance is necessary since exports are essential for simulating the economic progress and development of a nation.

- To determine the strengths and weaknesses of States and UTs across export-related characteristics, the index conducts a thorough examination of each.

-

Pillars:

- Policy: A comprehensive trade policy offering strategic import and export direction.

- Business Ecosystem: An effective business ecosystem helps states in attracting investments and building up the necessary infrastructure to support start-ups by people.

- Export Ecosystem: Analyse the export-specific business environment.

- Export Performance: It evaluates the state and UT export footprints and is the sole output-based parameter.

- Ten Sub Pillars: Export Promotion Policy; Business Environment; Infrastructure; Transport Connectivity; Export Infrastructure; Institutional Framework; Trade Support; R&D Infrastructure; Export Diversification; and Growth Orientation.

- Features: The Export Promotion Index (EPI) is a data-driven initiative to identify the key regions essential for export promotion at the sub-national level (states and union territories).

Key Highlights of the EPI 2022

-

Performance of States:

-

Top Performers:

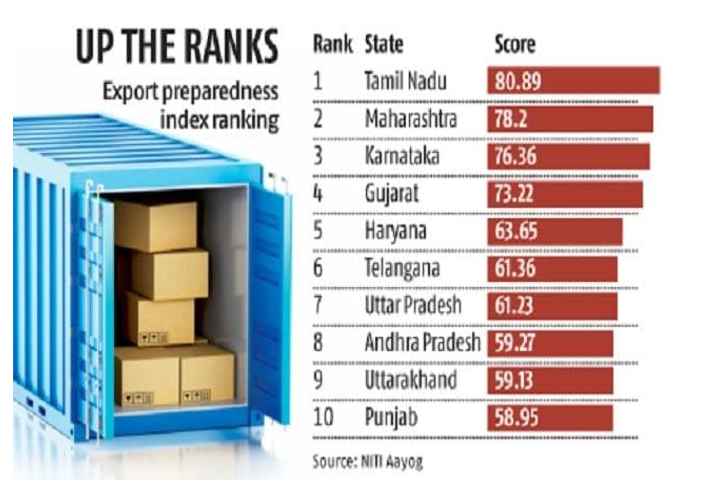

- In EPI 2022, Tamil Nadu came in first place, followed by Maharashtra and Karnataka.

- Gujarat, which was ranked first in EPI 2021 (which was published in 2022), has dropped to fourth place in EPI 2022.

- The success of Tamil Nadu in terms of export performance measures, such as the number of exports, the concentration of exports, and the size of the worldwide market, led to its top ranking.

- In industries including automotive, leather, textiles, and electrical products, it has consistently been a leader.

- Hilly/Himalayan States: The Himalayan/hilly state with the highest score in the EPI 2022 was Uttarakhand. After that came Himachal Pradesh, Manipur, Tripura, Sikkim, Nagaland, Meghalaya, Arunachal Pradesh, and Mizoram.

- Landlocked Regions: Among the landlocked areas, Haryana topped the list, indicating its preparedness for exports and followed by Telangana, Uttar Pradesh, Punjab, Madhya Pradesh, and Rajasthan.

- Union Territories/Small States: Goa came out on top in the EPI 2022 among union territories and small states. The second, third, fourth, and fifth places, respectively, were taken by Jammu & Kashmir, Delhi, the Andaman and Nicobar Islands, and Ladakh.

-

Global Economy:

- After Covid-19, there were prospects for improvement in global trade in 2021. A 27% rise in product trade and a 16% increase in services trade over the prior year was attributed to factors like rising demand for goods, fiscal measures, the distribution of vaccines, and the relaxation of barriers.

- The recovery was delayed down by the Russo-Ukrainian war in February 2022, which affected the grain, oil, and natural gas industries.

- Trade in goods increased significantly, and by Q4 2021, services trade had recovered to pre-pandemic levels.

-

India’s Export Trends:

- India's exports in 2021–22 exceeded a historic USD 675 billion, with trade in products accounting for USD 420 billion, despite the global slowdown.

- An ambitious target established by the government, the value of merchandise exports surpassed USD 400 billion in FY2022 and might reach USD 422 billion by March 2022.

- This performance has a variety of causes. India's exports of goods increased due to rising global commodity prices and increased demand from industrialised nations.

Key Learnings of the Exports Preparedness Index (EPI)

- The country's coastline states have performed the best across all categories, accounting for six of the top ten states in the index.

- States like Gujarat, Karnataka, Maharashtra, and Tamil Nadu (all of which are performing the best in at least one pillar) are examples.

- As for the policy ecosystem's positive aspects, several governments have adopted the required measures to promote exports inside their borders.

- 73% of districts in the nation have an export action plan, and more than 99% are included in the "One District, One Product" Scheme.

- In terms of transportation connections, states have lagged. Lack of air connectivity makes it difficult for goods to move between areas, especially in states which are landlocked or geographically disadvantaged.

- The nation's worse performance in terms of Research and Development (R&D) reveals a disregard for the importance of innovation in exports.

- The state's government must continue and expand its assistance to the ailing industry.

- In 26 states throughout the nation, the manufacturing sector's gross value addition has decreased.

- Ten states have seen a decline in foreign direct investment (FDI) inflow.

- Because only 25 of the 36 states have organised less than 10 workshops in a year, exporters' ability to enter international markets is hampered by the paucity of capacity-building workshops.

- Timely project approval is essential for the success of current government programmes to assist states.

Recommendations of the EPI

- Adoption of Good Practices: If they meet their needs, states should be encouraged to embrace successful strategies from their contemporaries. The performance of trailing states' exports can be improved by taking lessons from successful states.

- Investment in Research and Development (R&D): To promote product innovation, market-specific product development, product quality improvement, cost reduction, and efficiency improvement, states should invest in R&D.

- Leveraging Geographical Indication (GI) Products: To create a foothold in the international market, states should make use of their distinctive GI goods. Exports can increase by promoting and enhancing the production and quality of GI goods. For example, Tamil Nadu is the only state that may export Kancheepuram Silk goods, and there is no rivalry nationwide.

- Diversification of Export Markets: India's export potential may be increased by identifying and supporting high-growth industries including information technology, pharmaceuticals, the automobile, textile, and renewable energy industries.