- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

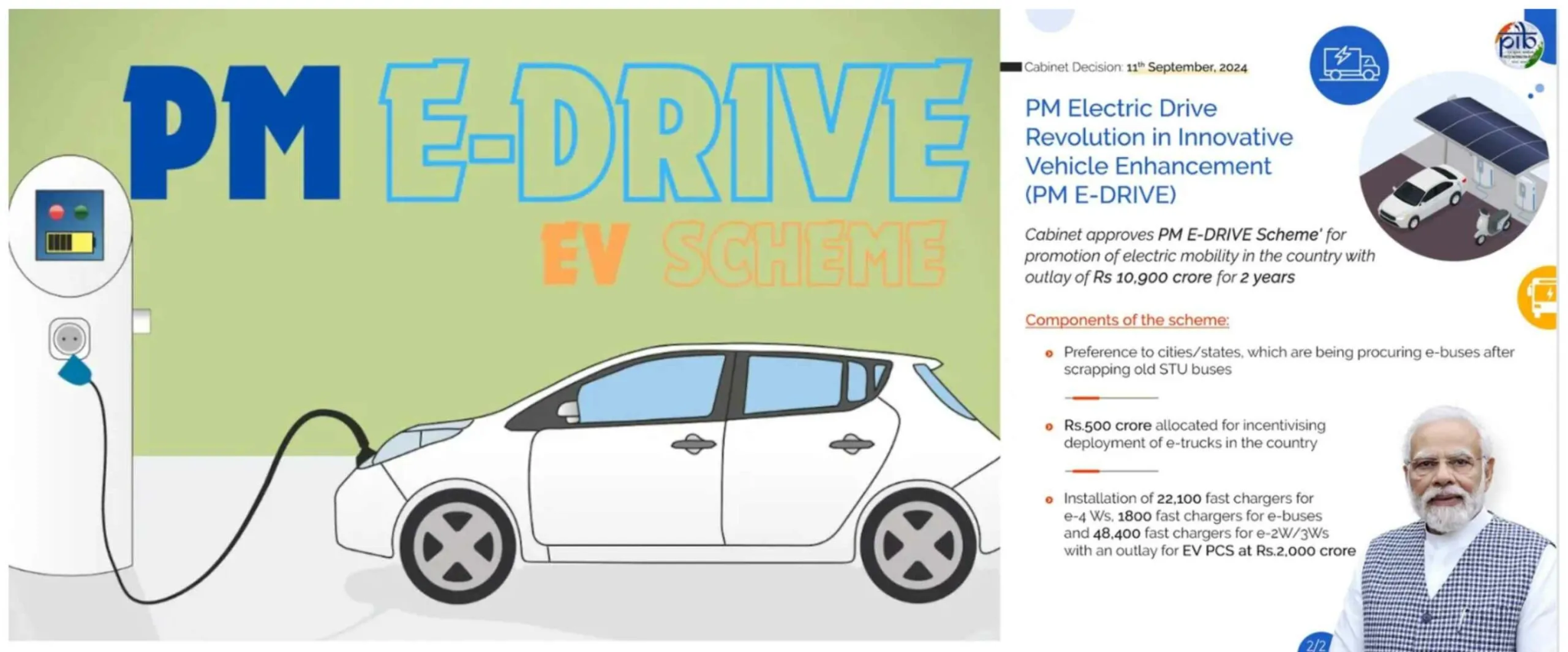

Electric cars excluded from PM E-DRIVE scheme

Electric cars excluded from PM E-DRIVE scheme

24-09-2024

The PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme excludes electric cars from direct subsidies, relying instead on lower GST and other measures to support the electric vehicle (EV) sector.

Overview of the PM E-DRIVE Scheme

- Financial Outlay: ₹10,900 crore over two years, replacing the previous FAME II scheme.

- Scope:

- Provides fiscal incentives for:

- 25 lakh electric two-wheelers

- 3 lakh electric three-wheelers

- 14,000 electric buses

- Electric cars are not eligible for any subsidies.

- Provides fiscal incentives for:

- Additional Provisions:

- Establishment of public charging stations.

- Modernization of testing agencies for green mobility technologies.

Background: The FAME Scheme

- FAME Policy: Launched in 2015 to reduce vehicular emissions and promote sustainable transport under the National Electric Mobility Mission Plan.

- Key Phases:

- FAME I (2015-2019): Focused on incentives for electric and hybrid vehicles, along with charging infrastructure.

- FAME II (2019-2024): Expanded funding to USD 1.19 billion, emphasizing public transport and emission reduction.

Key Facts About the Promotion of Electric Cars

- Impact of Exclusion:

- Sales of electric cars declined by 9% from April to August 2024 compared to the months before FAME II ended.

- Charging Infrastructure:

- Approximately 25,000 public charging stations for 46 lakh registered EVs, leading to a high ratio of 184 EVs per charging station.

Supporting Measures

- Production Linked Incentive (PLI) Schemes: Aim to support the EV sector through incentives for auto components and advanced battery technology, which could lower production costs.

- Lower GST: Electric cars benefit from a 5% GST, significantly lower than rates for hybrid and internal combustion engine vehicles (28% and 49%, respectively).

Current Context and Industry Response

- The PM E-DRIVE scheme emphasizes support for two- and three-wheelers and buses, explicitly omitting electric cars. This aligns with government views that current measures (lower GST, localization schemes, and charging station funding) are sufficient.

- The Minister of Road Transport and Highways indicated that subsidies are no longer necessary due to declining battery costs and economies of scale.

Sales Trends Post-FAME II

- Following the end of FAME II, electric car sales declined significantly, averaging 7,456 registrations per month from April to August 2024, with a low of 6,300 in August, reflecting a 10% decline compared to the previous year.

- The absence of fiscal incentives indicates that the electric car market still requires support to become self-sustaining.

Challenges

- Inadequate Charging Infrastructure: The current charging station ratio is significantly higher than in other countries promoting e-mobility, complicating consumer adoption.

- Many public charging stations are not equipped for electric cars or do not provide fast charging.

Conclusion

The exclusion of electric cars from the PM E-DRIVE scheme raises concerns about future sales and market sustainability. Enhanced infrastructure and supportive measures are crucial for promoting electric mobility and achieving the government’s goal of 30% electric vehicle penetration by 2030.