- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Direct Taxes At 14-Year High

Direct Taxes At 14-Year High

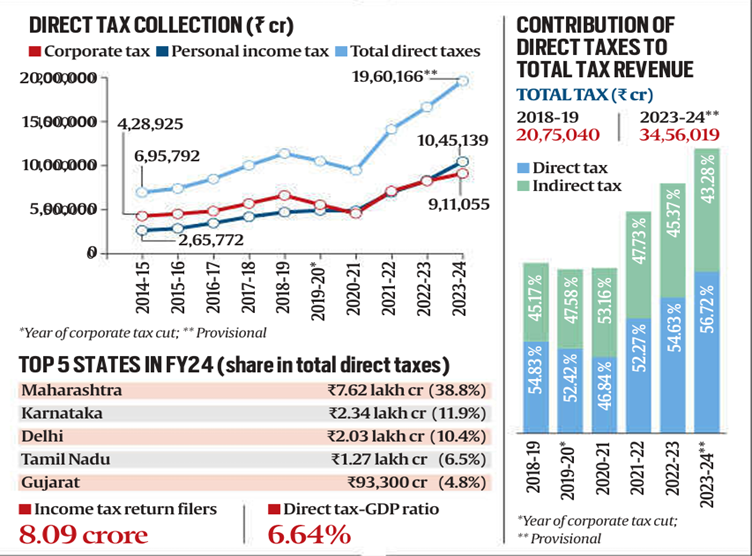

In Oct 2024, data from the Central Board of Direct Taxes (CBDT) revealed that direct taxes have surged to 57.72% of total tax revenue in 2023-24, the highest level in 14 years. The direct tax-to-GDP ratio has also reached 6.64%, the highest in 2 decades.

Key Statistics

- Direct Tax Contribution: 57.72% of total tax revenue

- Direct Tax-to-GDP Ratio: 6.64%

- Indirect Tax Contribution: 43.28% of total tax revenue

- Personal Income Tax Collections: ₹10.45 lakh crore (exceeding corporate tax collections of ₹9.11 lakh crore for the second consecutive year)

- Tax Buoyancy: Increased to 2.12 in 2023-24 from 1.18 in the previous financial year

- Cost of Total Tax Collection: Reduced to 0.44% in FY24, the lowest since 2000-01

|

Why lesser indirect tax share to total tax revenue is not worrisome? Indirect tax is regressive in India and levied across the board and so that impact the poor more than the well to -do.If the share for it is lesser than the direct tax share , it points towards the lesser impact on poorer sections of society. |

What is Tax and Taxation?

- Tax: Involuntary fees imposed on individuals, businesses, or corporations by government entities.

- Taxation: The process through which the government collects taxes to fund public services, promote economic stability, and ensure social equity.

Key Taxation Terms

- Tax Base: The total value of goods, services, and incomes subject to taxation by government authority.

- Tax Revenue: The income collected by the government from taxes imposed on individuals, businesses, and other entities.

- Adjusted Tax Revenue: Tax revenue calculated after accounting for discretionary changes.

- Tax Incidence: Refers to the actual payer of the tax.

Types of taxes: Direct taxes and Indirect Taxes

- Direct Tax: Direct Tax refers to the type of tax that is borne by a person/entity on whom it is levied. Thus, in this case, the Impact of Tax and the Incidence of Tax fall on the same person or entity. In other words, the burden of a Direct Tax cannot be shifted to another person or entity.

- Administered by: CBDT under the Ministry of Finance.

- Examples in India:

- Income Tax (IT)

- Corporate Tax

- Minimum Alternate Tax (MAT)

- Alternate Minimum Tax (AMT)

- Capital Gains Tax (CGT)

- Securities Transaction Tax (STT)

- Dividend Distribution Tax (DDT)

- Wealth Tax

- Banking Cash Transaction Tax (BCTT)

- Digital Tax (Google Tax, GAFA Tax, Equalization Levy)

- Indirect Tax: Indirect Tax refers to the type of tax for which the Impact of Tax and Incidence of Tax fall on different persons or entities. They are, generally, imposed on goods and services.

- Examples:

- Customs duty

- Sales tax

- Excise duty

- Service tax

- Value Added Tax (VAT)

Difference between Direct and Indirect Taxes:

|

Parameter |

Direct Tax |

Indirect Tax |

|

Meaning |

Levied directly on the individuals or corporations |

Levied on one entity but is passed on to the final consumer |

|

Incidence |

The incidence and impact of the direct tax fall on the same person |

The incidence and impact of the tax fall on different persons. |

|

Nature |

Progressive : The tax rate increases with the increase in income level |

Regressive: The tax rate is the same for all, irrespective of the income level. |

|

Administrative cost |

Higher |

Lower |

|

Tax Evasion |

Possible |

Not possible |

What are the Steps Taken by the Government to Boost the Direct-Tax Collection?

- Vivad se Vishwas Scheme: Under Vivad se Vishwas, declarations for settling pending tax disputes are filed. This will benefit the Government by generating timely revenue and to the taxpayers by bringing down mounting litigation costs.

- Direct Tax Code: It is a proposed legislative reform of the direct taxation system. It aims to simplify and combine all of the federal government’s direct taxes, such as income tax, gift tax, and wealth tax and aims to extend the tax base to enhance tax revenue.

- For Personal Income Tax: The Finance Act, 2020 has provided an option to individuals and co-operatives to pay income tax at concessional rates if they do not avail of specified exemptions and incentives.

- Expansion of scope of TDS/TCS: To widen the tax base, several new transactions were brought into the ambit of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS). These transactions include huge cash withdrawals, foreign remittances, purchase of luxury cars, e-commerce participants, sale of goods, acquisition of immovable property, etc.

- Transparent Taxation: Honouring The Honest Platform: It is aimed at bringing transparency in income tax systems and empowering taxpayers.

What is Income Tax?

- It is a type of direct tax that is charged directly on the income of an entity such as Individuals, Hindu Undivided Families (HUFs), Cooperative Societies, Trusts, Partnership Firms, Companies, etc. ]

- Income tax is charged on “taxable income”, which depends on the total income and exemptions applicable.

Taxable Income = Total Income – Applicable Deductions and Exemptions.

Income Tax is of 2 types – Personal Income Tax and Corporate Income Tax.

- Personal Income Tax

- It is often referred to as simply Income Tax, though it is a sub-type of Income Tax.

- Personal Income Tax is the income tax levied on the incomes of Individuals, Households, Hindu Undivided Families (HUF), Partnership Firms, Sole Proprietorships, etc.

- Various types of income covered under Personal Income Tax are – salary, profits from business/profession, rental income, income from interest, royalty, etc.

- It is governed by the Income Tax Act, 1961 (IT Act, 1961).

- Corporate Income Tax or Corporate Tax

- It is often referred to as simply Corporate Tax.

- Corporate Income Tax is the income tax levied on profits earned by the incorporated firms or companies.

- Thus, similar to Personal Income Tax, Corporate Tax is also a type of Income Tax.

- But, since the contribution of Corporate Tax to the overall tax revenue is significantly high, so it has been made a separate category of income tax.

- Companies, both public and private, which are registered in India under the Companies (Amendment) Act, 2019 are liable to pay Corporate Tax.

- It is also governed by the Income Tax Act, 1961 (IT Act, 1961).

Tax to GDP Ratio

- Measures tax collected as a percentage of GDP; higher ratios indicate better capacity for government spending.

- Current Status: Approximately 6% of India's population pays income tax (~8 crore people out of 132 crore). Gross tax to GDP ratio is 11.1% in 2023, expected to rise to 11.7% in 2024.

Tax Buoyancy and Elasticity

- Tax Buoyancy: A measure of revenue growth relative to GDP growth; increased to 2.12 in 2023-24 from 1.19 in the previous year, indicating effective revenue mobilization.

- Tax Elasticity: Assesses the responsiveness of tax revenue to changes in the tax base or tax rates.

Conclusion

Despite significant reforms leading to increased direct tax collections, India remains a largely tax non-compliant society, as indicated by its low tax-to-GDP ratio compared to developed nations. Continued reforms to simplify tax structures and leverage technology are essential for improving tax compliance and broadening the tax base.