- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Centre’s Tax Devolution to States

Centre’s Tax Devolution to States

Latest Context

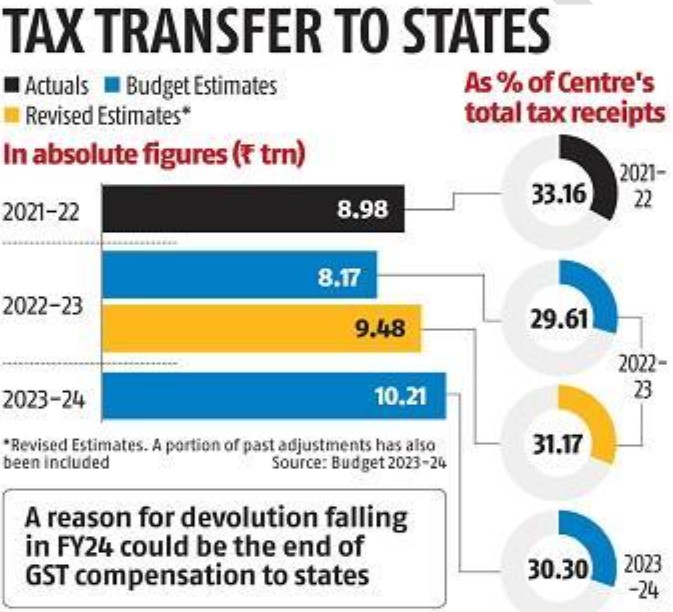

Recently, the 3rd Instalment of Tax Devolution to state governments amounting to Rs 1,18,280 crore in June 2023 has been released by the Union government against the normal monthly devolution of Rs 59,140 crore. Devolution of Tax to states will make them capable to speed up financing their development/welfare-related expenditure, and capital spending in addition to keeping the resources for priority projects/ schemes.

Key Note: Among all states, Uttar Pradesh received the highest (Rs 21,218 crore) amount then it was followed by Bihar (Rs 11,897 crore), Madhya Pradesh, West Bengal and Rajasthan.

Tax Devolution

- Introduction: Tax devolution means the distribution of tax revenues between the central government and the state governments. Indian Constitution has specific provisions to allocate the proceeds of some taxes among the Centre and the states in a fair and equitable manner.

- Article 280(3)(a) of the Constitution of India make special provisions for constituting the Finance Commission (FC) in order to make recommendations regarding the division of the net proceeds of taxes between the Union and the states.

Key Recommendations of the 15th Finance Commission:

- Share of States in Central Taxes (Vertical Devolution): The proportion of states in the central taxes for the 2021-26 period is recommended to be 41%, which is the same as that for 2020-21. It is less than the 42% which was recommended by the 14th Finance Commission for the 2015-20 period. In order to provide revenue to the newly formed union territories of Jammu and Kashmir, and Ladakh from the resources of the centre, a 1% share has been increased.

- Horizontal Devolution (Allocation Between the States): Finance Commission has recommended 15% each to population and area, 45% to income, 10% to forest and ecology, 12.5% weightage to demographic performance, and 2.5% to tax and fiscal efforts.

- Revenue Deficit Grants to States: Revenue Deficit refers to the difference between revenue expenditure and revenue receipts that comprises tax and non-tax. Post-devolution revenue deficit grants amounting to approximately Rs. 3 trillion over the five-year period ending FY26 was suggested by Finance Commission.

- Performance-Based Incentives and Grants to States These grants are based upon four main themes.

- First is the social sector which lays emphasis on health and education,

- Second is a rural economy, with a focus on agriculture and the maintenance of rural roads. It comprises country’s two-thirds of the country's population, 70% of the total workforce and 46% of the national income.

- Third one is governance and administrative reforms that consists the grants for the judiciary, statistics, aspirational districts, and blocks.

- Fourth is Power Sector which comprises a performance-based incentive system for the power sector that is not connected to grants but offers an important, additional borrowing window for States.

- Grants to Local Governments

- It comprises performance-based grants for the development of new cities and health grants to local governments in addition to the grants for municipal services and local government bodies. In Urban local bodies grants, only cities/towns having a population of less than a million are provided with the basic grants.

- Million-Plus- Cities are given a hundred per cent grant based upon performance through the Million-Plus Cities Challenge Fund (MCF). On the performance of these cities with respect to their capability for improving their air quality and meeting the service level benchmarks for urban drinking water supply and sanitation and solid waste management, MCF grants are allotted.

Role of the FC in Maintaining Fiscal Federalism

- Distribution of Tax Proceeds: It plays a very significant role in the distribution of the net proceeds of taxes between the Union government and the state governments to secure fair and equitable sharing of tax revenues by paying on the fiscal capacities and needs of the states.

- Allocation of Taxes Among States: Additionally, it decides the principles and quantum of grants-in-aid for the states that need financial assistance. It determines the financial needs of states and suggests measures for allocating funds from the consolidated funds of the states.

- Increasing Resources of Local Governments: It also recommends measures to enhance the consolidated fund of a state to supplement the resources of Panchayats and Municipalities in that state.

Cooperative Federalism:

- Finance Commission plays a very important role in maintaining the spirit of Cooperative Federalism by having extensive consultations with all levels of government.

- To gather inputs and ensure a participatory approach in decision-making, it consults with the central government, state governments, and other stakeholders

Public Spending and Fiscal Stability:

Finance Commission’s recommendations are focused on improving the quality of public spending and promoting fiscal stability. The Commission provides guidance on fiscal management, resource allocation, and expenditure priorities by evaluating the financial position of the Union and state governments,

15th Finance Commission

- It is a constitutional body that devises the method and formula in order to distribute the tax proceeds between the Centre and states, and among the states as per the constitutional arrangement and present requirements.

- Article 280 of the Indian Constitution makes a special provision under which it is the duty of the President of India to constitute a Finance Commission at an interval of five years or earlier. The 15th Finance Commission was constituted by the President of India, under the chairmanship of NK Singh in November 2017. Its task is to make recommendations for a period of five years from the year 2021-22 to 2025-26.

Prelims

Q. Consider the following: (2023)

1. Demographic performance

2. Forest and ecology

3. Governance reforms

4. Stable government

5. Tax and fiscal efforts

For the horizontal tax devolution, the Fifteenth Finance Commission used how many of the above as criteria other than population area and income distance?

(a) Only two

(b) Only three

(c) Only four

(d) All five

Ans: (b)

Mains

Q. Discuss the recommendations of the 13th Finance Commission which have been a departure from the previous commissions for strengthening the local government finances. (2013)