- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

Capital Gains Tax (CGT)

Capital Gains Tax (CGT)

09-05-2024

Finance Minister Nirmala Sitharaman has denied the reports that the Income Tax (I-T) Department is planning to introduce changes in the capital gains tax structure.

What is Capital Gains Tax (CGT)?

- Definition: Capital gains refer to profits earned from selling capital assets.

- Examples of Capital Assets: Land, buildings, vehicles, patents, trademarks, leasehold rights, machinery, and jewelry.

- Duration: Capital gains can be classified as short-term or long-term based on the holding period.

- Taxation: Capital gains are considered income and are subject to taxation.

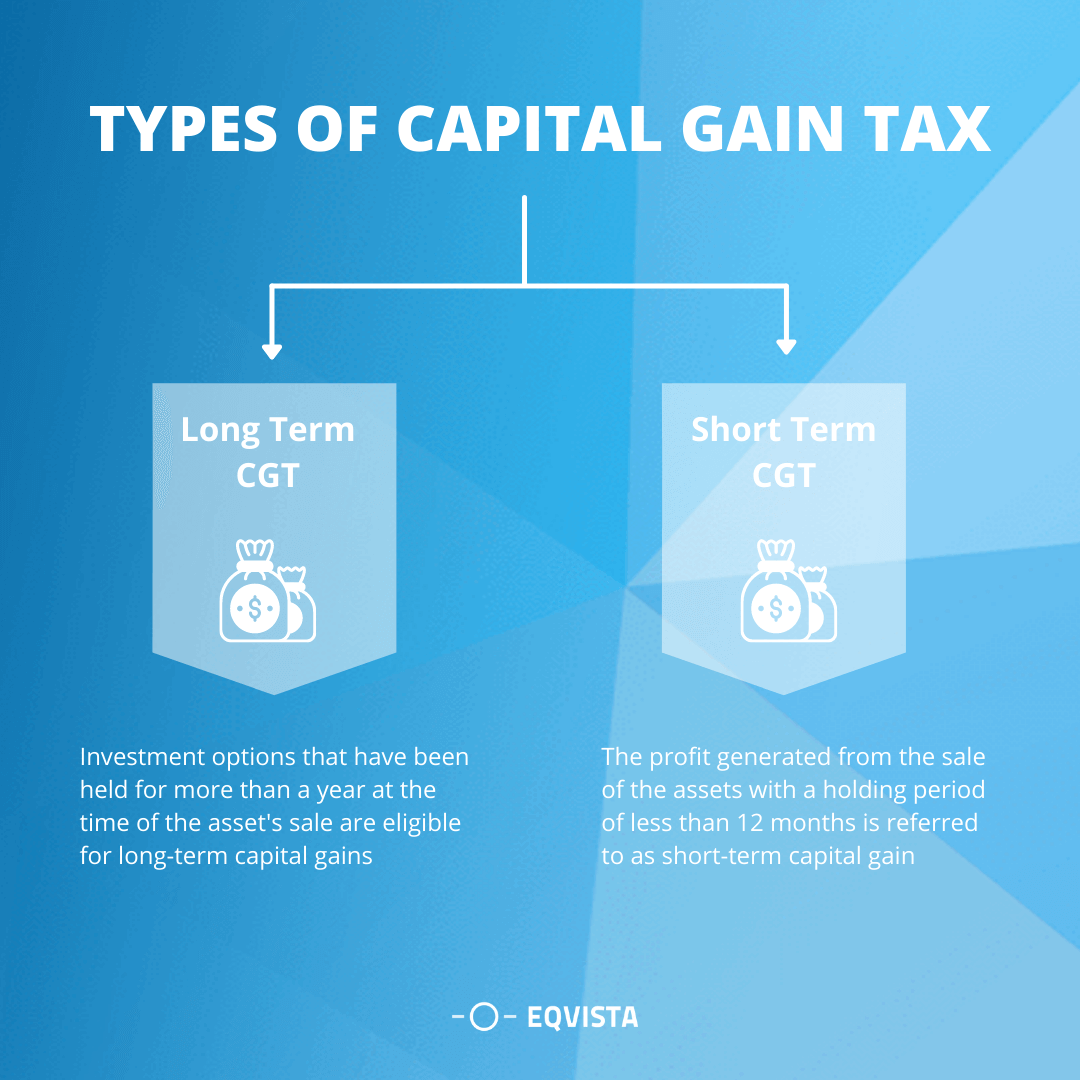

Types of CGT:

-

Short-Term CGT:

- Assets held for less than 36 months (24 months for immovable properties).

- Profits from selling such assets are considered short-term capital gains and taxed accordingly.

-

Long-Term CGT:

- Assets held for over 36 months.

- Assets like preference shares, equities, UTI units, securities, equity-based Mutual Funds, and zero-coupon bonds are treated as long-term capital assets if held for over a year.

- Profits from selling such assets are considered long-term capital gains.

Conclusion:

Understanding Capital Gains Tax is crucial for individuals and businesses involved in the sale of capital assets.

Must Check: Best IAS Coaching In Delhi