- Courses

- GS Full Course 1 Year

- GS Full Course 2 Year

- GS Full Course 3 Year

- GS Full Course Till Selection

- Answer Alpha: Mains 2025 Mentorship

- MEP (Mains Enrichment Programme) Data, Facts

- Essay Target – 150+ Marks

- Online Program

- GS Recorded Course

- Polity

- Geography

- Economy

- Ancient, Medieval and Art & Culture AMAC

- Modern India, Post Independence & World History

- Environment

- Governance

- Science & Technology

- International Relations and Internal Security

- Disaster Management

- Ethics

- NCERT Current Affairs

- Indian Society and Social Issue

- NCERT- Science and Technology

- NCERT - Geography

- NCERT - Ancient History

- NCERT- World History

- NCERT Modern History

- CSAT

- 5 LAYERED ARJUNA Mentorship

- Public Administration Optional

- ABOUT US

- OUR TOPPERS

- TEST SERIES

- FREE STUDY MATERIAL

- VIDEOS

- CONTACT US

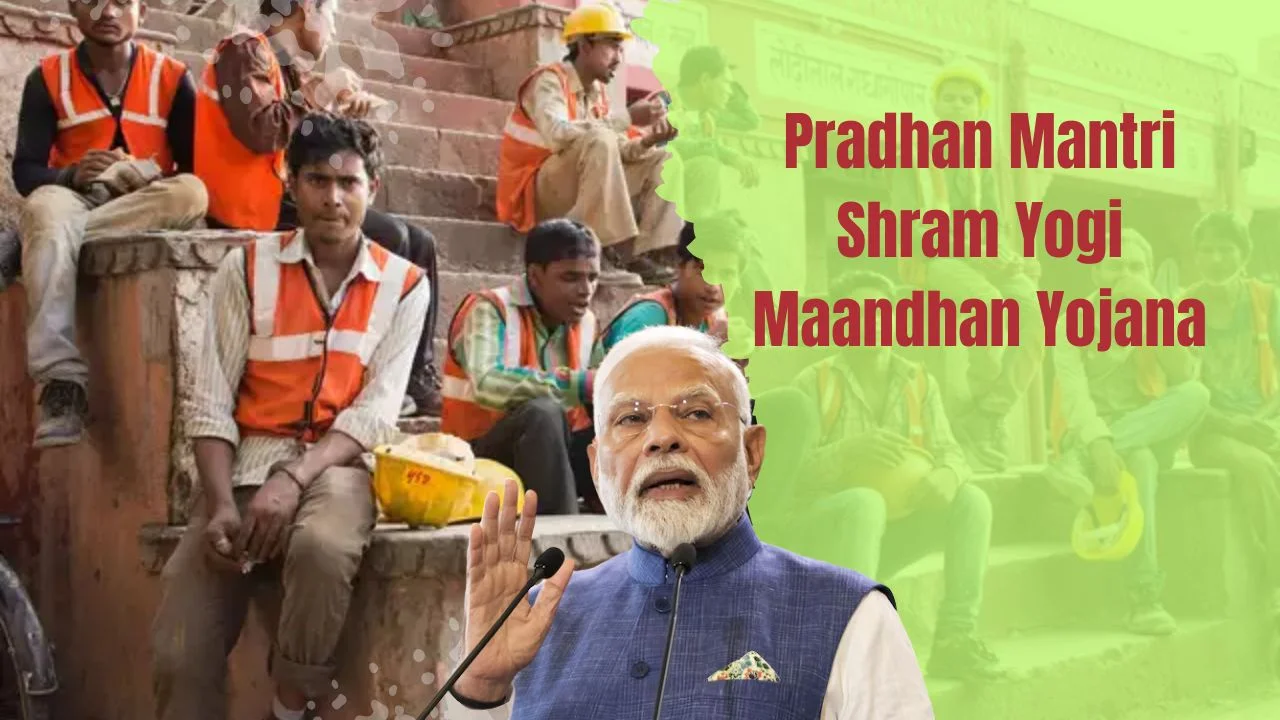

6 Years Of Pradhan Mantri Shram Yogi Maandhan Yojana

6 Years Of Pradhan Mantri Shram Yogi Maandhan Yojana

06-03-2025

- Recently, Indian Government celebrated 6 years of Pradhan Mantri Shram Yogi Maandhan (PM-SYM)

- It is a pension scheme for workers in the unorganised sector.

- Also in December 2024, A Parliamentary Standing Committee (PSC) report raised concerns over the underperformance of the Pradhan Mantri Shram Yogi Maandhan Yojana (PM-SYM).

|

Parliamentary Committees (PC)

|

What is the Pradhan Mantri Shram Yogi Maandhan Yojana (PM-SYM)?

- About: PM-SYM is a Central Sector Pension Scheme launched in 2019 by the Government of India, administered by the Ministry of Labour and Employment.

- Under this scheme, Life Insurance Corporation of India (LIC) act as the Pension Fund Manager.

- Target Beneficiaries: The scheme aims at workers in the unorganised sector aged between 18 and 40, such as street vendors, domestic workers, construction labourers, agricultural workers, etc., with a monthly income of up to ₹15,000.

- Pension Benefits: PM-SYM guarantees a pension of ₹3,000 per month after the worker turns 60.

- However, if the worker passes away before 60, there is no lump sum payment to their family.

- The spouse of the deceased worker will receive 50% of the pension amount as a family pension.

Implementation and Current Status:

- Coverage: 36 States/UTs

- Enrollments: 46,12,330 (March 2025)

- Top 3 States: Haryana, Uttar Pradesh, Maharashtra

Contribution Structure

The contribution amount varies based on the age at the time of enrolment. The earlier a worker enrolls, the lower the monthly contribution.

What are the Highlights of the PSC Report on PM-SYM?

- Poor Performance of PM-SYM:

- The PM-SYM scheme has performed poorly, mainly due to low enrolment and reduced government funding.

- Government contributions have halved over the past two years.

- In FY 2023-24, the expenditure was ₹162.51 crore, down from ₹324.23 crore in FY 2021-22.

- But, In the Union Budget 2025-26, the allocation for PM-SYM has been increased to ₹244.2 crore

- The PM-SYM scheme had a target of enrolling 100 million workers by 2023 but achieved only 5 million enrollments by FY 2024, covering less than 1% of the 565 million strong unorganised workforce.

- Despite this, the government has extended the scheme until 2025-26.

- Reasons for Poor Performance:

- Income Challenges: Unorganised workers, especially daily wage earners, often have irregular incomes and unstable employment, making it difficult to afford the monthly premium ranging from ₹55 to ₹200.

- Impact of Covid-19: The COVID-19 pandemic further exacerbated the financial challenges of unorganised workers, limiting their ability to contribute to the scheme.

- Structural Barriers: The lack of a formal employer-employee relationship in the unorganised sector leads to difficulties in accessing the scheme due to insufficient documentation and a lack of awareness.

- Existing Pension Alternatives: The availability of other pension schemes like Atal Pension Yojana (APY) may confuse workers, leaving them uncertain about which scheme to opt for.

- Recommendations for Revamping the Scheme:

- Expand Entry Age: Increase the eligibility age from 40 years to 50 years to include older unorganised workers.

- Scheme Merger: Merge PM-SYM with the Atal Pension Yojana (APY) and Pradhan Mantri Laghu Vyapari Maandhan Yojana to ensure better alignment and broader coverage.

- e-Shram Portal: Utilize the e-Shram portal, which has a database of over 305 million workers, to streamline enrolment and ensure wider reach. Integration of PM-SYM with the e-Shram portal could make the enrolment process easier.

- Direct Benefit Transfer (DBT): Introduce subsidies for workers who cannot afford to pay the monthly premium, ensuring that they can still benefit from the scheme.

- Awareness Campaigns: Launch targeted outreach programs to improve awareness about the scheme and reduce misinformation, which could increase participation.

Who are Unorganised Workers?

- As per the Unorganised Workers' Social Security Act, 2008, unorganised workers include home-based workers, self-employed workers, or wage workers who are not covered by key labour laws (e.g., Employees' Compensation Act, Industrial Disputes Act, etc.).

- Examples: Unorganised workers include street vendors, agricultural labourers, domestic workers, construction workers, and other informal sector employees.

Initiatives for Unorganised Workers:

Several initiatives aim to improve the welfare of unorganised workers:

- e-Shram Portal: A comprehensive database of unorganised workers.

- Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY): Life insurance for the unorganised workforce.

- Pradhan Mantri Kaushal Vikas Yojana: Skill development for workers in the unorganised sector.

- Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana (AB-PMJAY): Health insurance for the unorganised sector.

- National Pension System (NPS): Voluntary, for government/private employees with tax benefits.

- Atal Pension Yojana (APY): For unorganised sector workers, offering a guaranteed pension between Rs 1,000–5,000/month.

- Pradhan Mantri Shram Yogi Maandhan (PM-SYM): Provides Rs 3,000/month for street vendors, domestic workers, etc.

- PM-Kisan Maandhan Yojana (PM-KMY): Rs 3,000/month pension for farmers.

Global Pension Context:

- India's Pension Ranking: Ranked last among 48 countries in the 2024

- Mercer CFA Institute Global Pension Index with a score of 44/100.

- Countries like Denmark, Netherlands, and Iceland top rankings with state-funded systems ensuring universal coverage.

- India’s system is mostly contribution-based, with low pension coverage, inadequate retirement income, and lack of regulatory oversight.

Projected Demographics:

- Ageing Population: By 2036, 227 million Indians (15% of population) will be 60+ years, increasing to 347 million (20%) by 2050.

- This necessitates a more inclusive pension model

.

International Models:

- Netherlands: 3-tier system (universal state pension, occupational pension, voluntary savings).

- Denmark: State-funded universal pension combined with mandatory occupational pensions.

- New Zealand: Flat-rate universal pension for all residents over 65, regardless of employment history.

- Sweden: Multi-pillar system (guaranteed minimum pension, income-related pension, optional premium pension).

|

Also Read |

|

| FREE NIOS Books | |